Bond Programmes

Global Medium Term Notes (GMTN)

Established in 2011, our USD 3bn Global Medium Term Note Programme currently has no outstanding securities. The programme is listed on the Euronext Dublin and NASDAQ Dubai.

Sukuk

Our USD 3bn Trust Certificate Issuance Programme has USD 2.2 bn of Sukuk certificates outstanding. The notes have maturities ranging from May 2029 to October 2035. The programme is listed

on the Euronext Dublin and NASDAQ Dubai.

Subordinated Perpetual Notes

We have USD 810mn of Subordinated Perpetual Notes outstanding; USD 310mn issued in June 2022 and USD 500mn issued in November 2025.The notes are listed on the Euronext Dublin and NASDAQ Dubai.

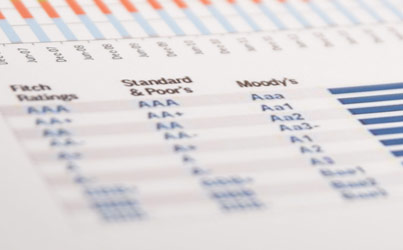

Credit Rating

S&P

With a BBB credit rating from Standard and Poor’s Ratings, we continue to be the highest rated private company from the region.

Fitch

With a BBB credit rating from Fitch Ratings, we continue to be the highest rated private company from the region.

Green Finance Framework

Green Finance Framework

Majid Al Futtaim has opted to develop a Green Finance Framework, under which it may issue Green Bonds or Green Sukuk as part of its commitment to leadership in sustainability in the global marketplace. The Framework has been designed in accordance with the Green Bond Principles 2018.

X